Testimonials

We take great pride in our clients hearing about us through the grapevine. Here are a just a few testimonials from some of our previous clients.

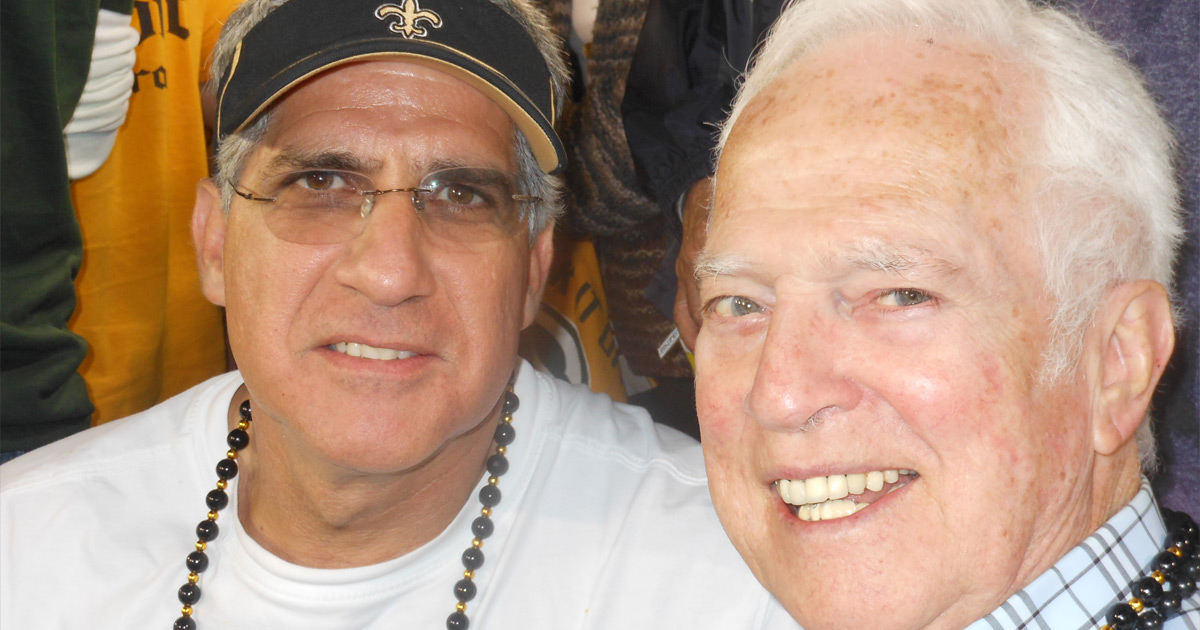

Meet Michael

My upbringing and life experiences are the reasons I do what I do. Born the sixth of eight children in Gentilly, a working-class neighborhood in New Orleans, family & service for others was ingrained in me at an early age.

Prompt Service in the Age of COVID

COVID-19 has changed so much about our lives – from the way my office does business to the way our families get together. Rest assured, my office stands ready to provide personal service and prompt attention to your needs.

'Family First ' more than just a motto

Meeting Michael Calogero for the first time isn’t as simple as meeting a man – you also meet his family. The lessons he’s learned from his hard-working parents were a major force behind his decision to specialize in estate planning.